Why inflation is not a problem for Japan and China?

Most countries worry about inflation.

Japan and China don’t.

Not because they don’t print money.

Not because they don’t stimulate.

Not because they don’t want growth.

But because their economies are structured in a way where inflation struggles to survive.

To understand why, you have to stop looking at prices and start looking at behaviour.

the common myth: “they just need more stimulus”

The usual explanation goes like this:

Japan has low inflation because policy wasn’t aggressive enough

China has low inflation because demand is weak temporarily

But this ignores a key fact:

Both countries have already done the things that are supposed to cause inflation.

Japan

near-zero interest rates since the late 1990s

massive quantitative easing after 2013

one of the largest central-bank balance sheets globally

China

repeated rate cuts

liquidity injections

large-scale credit creation over two decades

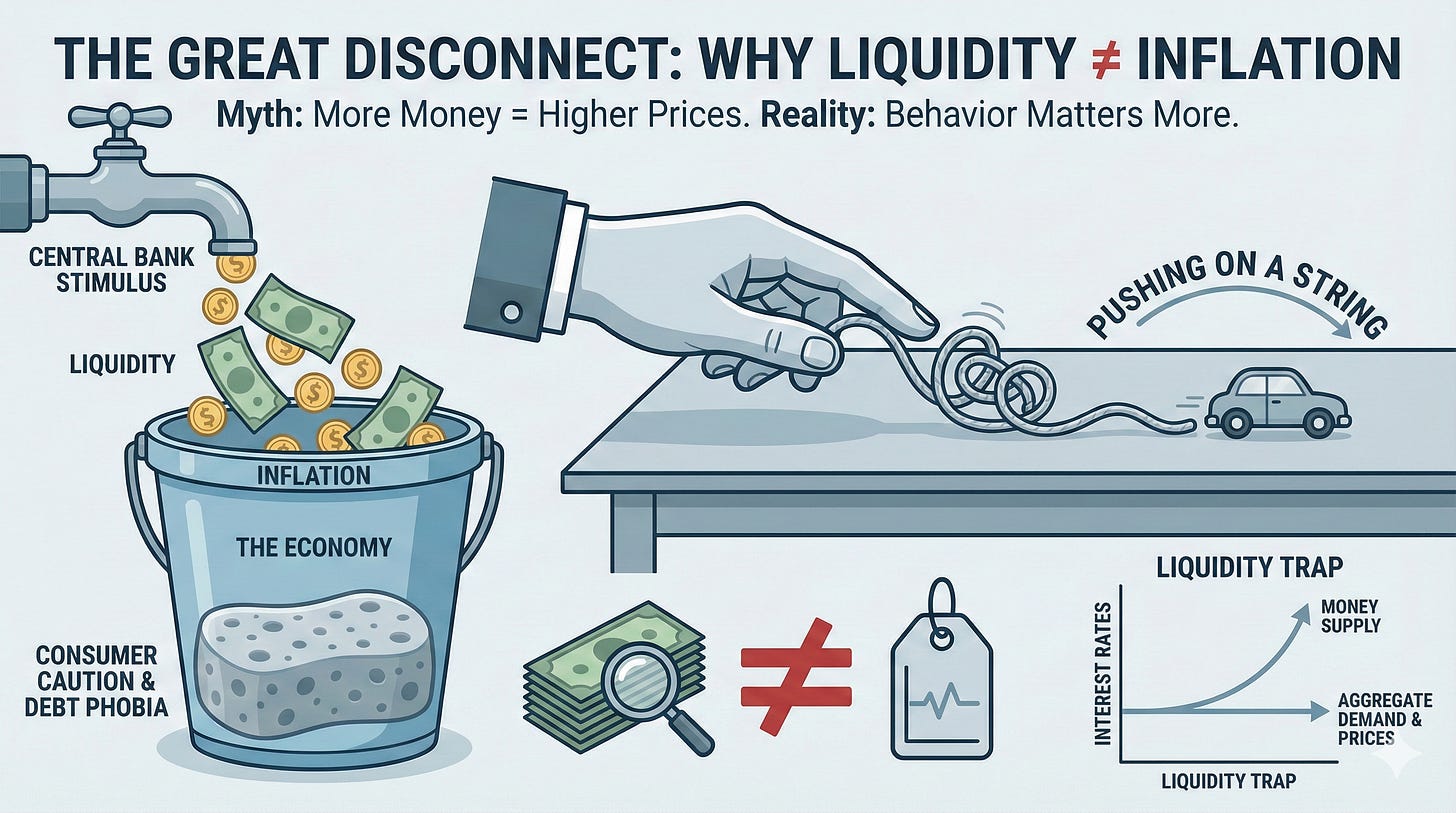

If inflation were simply about money supply,

both countries should have runaway prices by now.

They don’t.

inflation needs belief, not liquidity

Inflation doesn’t start when money is created.

It starts when people believe:

incomes will rise

jobs will be secure

demand will keep growing

That belief makes people:

borrow more

spend sooner

raise prices confidently

In Japan and China, that belief is missing.

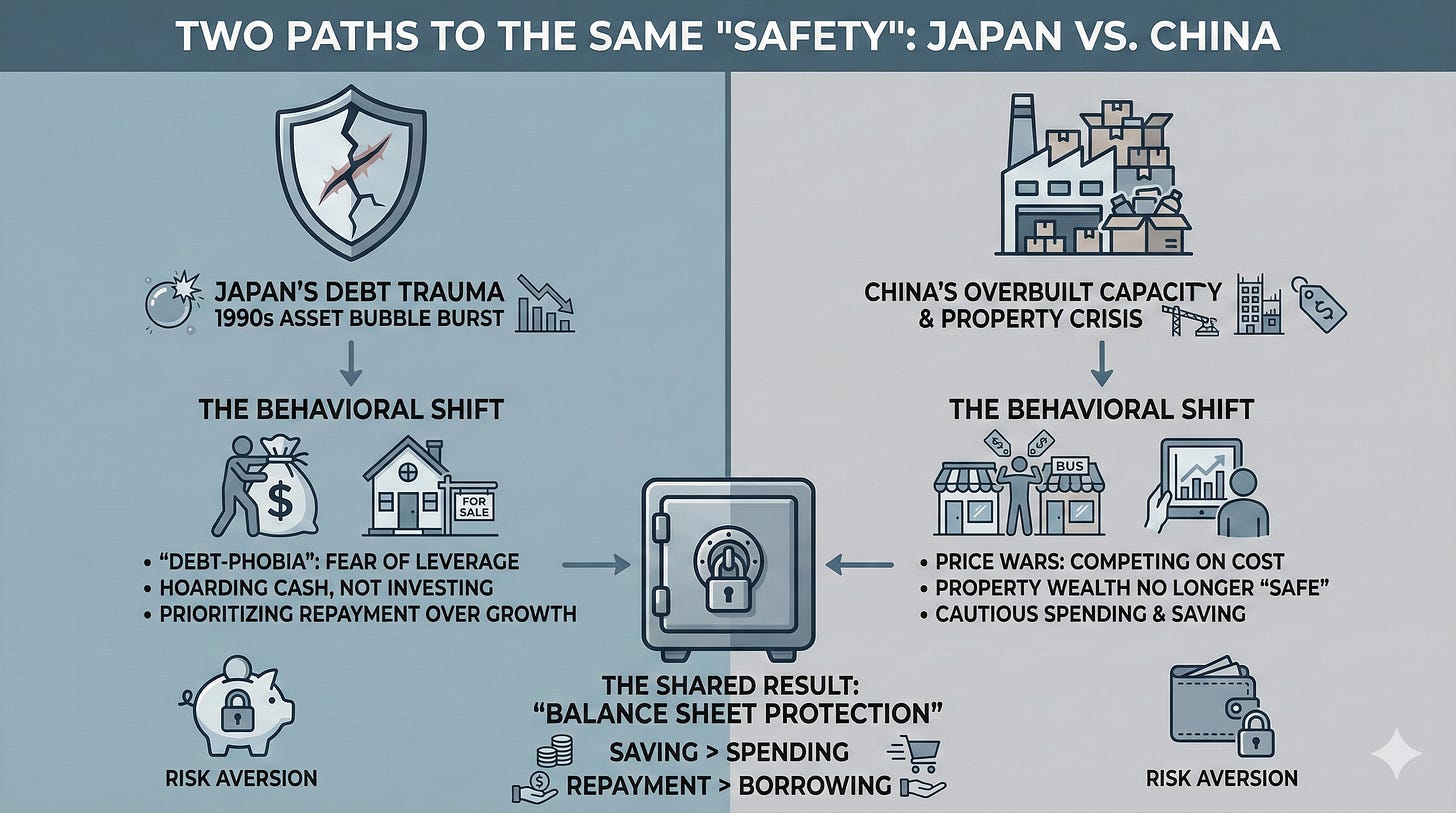

japan: the economy that learned to fear inflation

Japan’s inflation problem is actually a success problem from the past.

the 1990s trauma

late 1980s: asset bubble in stocks and real estate

early 1990s: bubble bursts

balance sheets collapse

Households, firms, and banks all learned the same lesson:

Debt can destroy you.

From that point on:

households saved more

firms avoided leverage

banks became conservative

Even decades later, that lesson stuck.

what japan does instead of inflating

When demand improves:

companies cut prices to protect market share

wages rise slowly, if at all

firms hoard cash instead of expanding capacity

Even during Abenomics (post-2013):

profits improved

stock markets rallied

liquidity surged

But behaviour didn’t flip.

Japan never returned to:

aggressive borrowing

rapid wage inflation

price-led demand cycles

So inflation never became persistent.

china: too much supply, too little pricing power

China’s story is different, but the outcome is similar.

China does not lack demand entirely.

It lacks pricing power.

china’s core issue: excess capacity

Over the last 20 years, China built:

too many factories

too much housing

too much infrastructure

This worked when:

urbanisation was fast

exports were booming

global demand was strong

But today:

population growth is slowing

property demand has peaked

global trade is fragmented

The result:

supply is abundant, demand is selective.

what happens when supply dominates

When companies compete in an overbuilt system:

prices are cut to survive

margins shrink

wages stay under pressure

This is why:

EV prices fall in China

manufacturing margins compress

exporters compete on price, not brand

You cannot get inflation when:

everyone is trying to sell

no one dares to raise prices

the property shock changed household behaviour

For Chinese households, property was:

the main store of wealth

the main source of confidence

After 2020:

developers collapsed

unfinished projects rose

property prices stagnated

That did something important:

It made households cautious.

When your biggest asset stops feeling safe:

you save more

you spend less

you delay big decisions

That behaviour is inflation-negative.

why stimulus doesn’t “stick” in both countries

Both governments can:

inject liquidity

support banks

push credit into the system

But they cannot force:

firms to invest aggressively

households to feel optimistic

wages to rise sustainably

So stimulus creates:

temporary activity

short bursts of price movement

But not a lasting inflation cycle.

Inflation fades because behaviour reverts to caution.

the shared pattern: balance sheet protection

Japan and China look different on the surface.

But underneath, they share the same behaviour.

When people feel:

scarred by past crashes

uncertain about future returns

unsure about asset values

they protect their balance sheets.

Protection mode means:

saving > spending

repayment > borrowing

competition > pricing power

Inflation cannot thrive in that environment.

why inflation is not a policy problem for them

For Japan and China:

inflation is not something to fight urgently

it’s something that rarely lasts anyway

Their bigger problems are:

weak wage growth

low confidence

falling returns on new investment

In that context, low inflation is a symptom, not a threat.

the contrast most people miss

Countries that struggle with inflation usually have:

younger populations

rising aspirations

stronger risk appetite

belief that tomorrow will be better

Japan and China currently don’t.

Which is why:

money creation doesn’t overheat

credit doesn’t explode

inflation never becomes a real problem

the one thing to remember

Inflation is not about:

how much money exists

It is about:

how people behave with that money

Japan and China don’t lack liquidity.

They lack willingness to take risk.

That’s why inflation isn’t their problem.

Top notch!

Had I told this to my teacher that inflation is not a necessity, he would have freaked out as basics of today's books are oriented towards indian economy only where controlled inflation (through central banks and government fiscal stimulus) is considered a tool for growth.

Anyways...

Considering the tighter control of government + aging population + trade surpluses also adds to this scenario along with past lessons that developed a culture of saving that let's these developed countries sustain this concept which won't be possible in still developing countries like india which is consumption oriented, has a younger population plus runs on trade deficit and also because of the shifts of newer generation towards spending that saving.

Nice write-up!

P.S.- Had to verify it since it's something that misses in general textbooks and Indian economic oriented editorials.