When people hear about a new IPO, the buzz is almost always the same:

👉 Grey market premium (GMP)

👉 Listing gains

👉 “Quick flip” profits

But here’s the real question: what actually matters when you’re deciding to invest in an IPO?

1. The First Thing to Check: Offer Structure

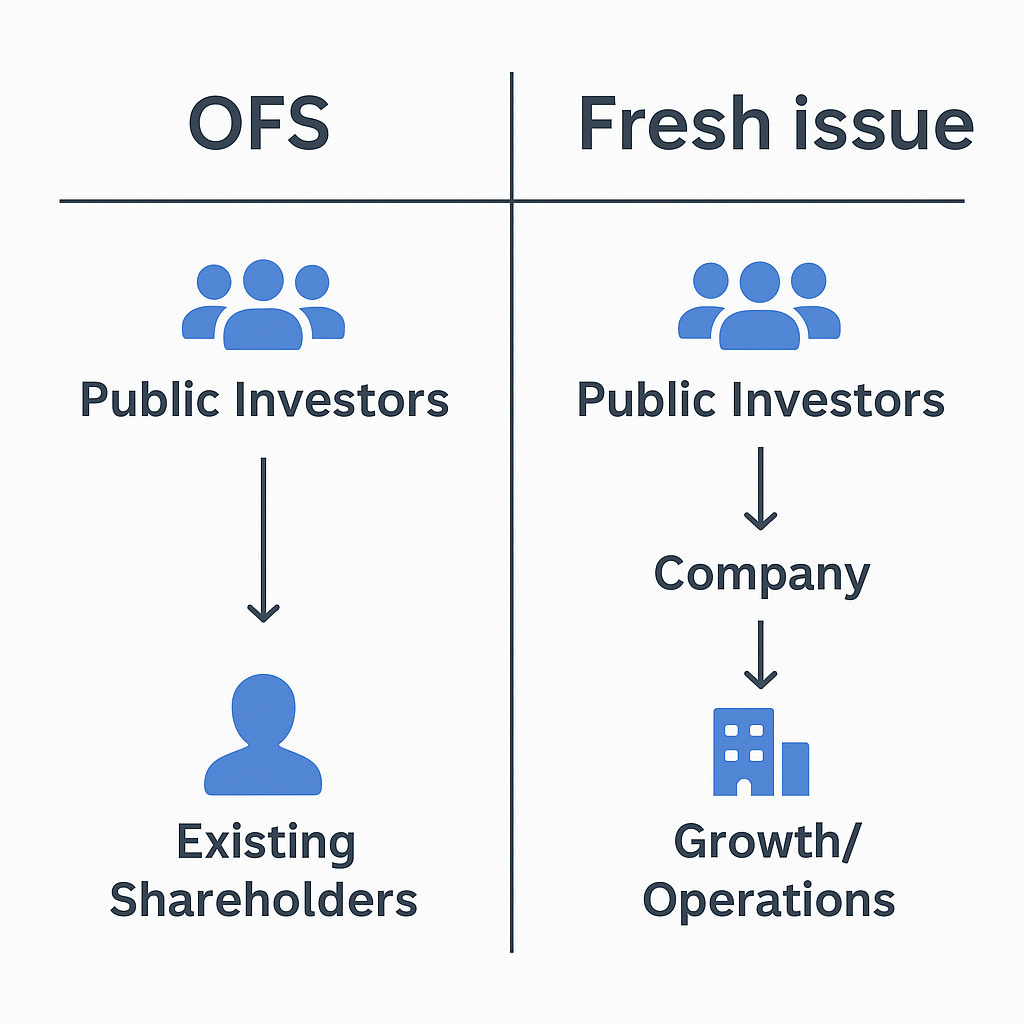

Every IPO has two possible components:

Offer for Sale (OFS): Existing investors (founders, VCs, PEs) sell their shares. The company doesn’t get any fresh money; ownership simply changes hands.

Translation: This is often an exit strategy for early investors. They bought cheap, scaled, and now want to cash out.

Red flag: If most of the IPO is OFS, ask yourself: Why are insiders rushing for the door?

This is not always a red flag, as a company might be generating healthy cash flows, so it doesn’t need additional capital, but investors might want to take an exit and realise their returns as everyone enters with a timeframe in mind.

Fresh Issue of Shares: The company issues new shares, raising money for itself. This does dilute existing owners, but it brings in fresh capital.

Translation: The company wants to fund growth, repay debt, or expand operations. This is usually more investor-friendly.

2. Where Will the Money Go?

This often gets ignored by retail investors, but it’s critical.

If funds are being used for growth (expansion, new plants, R&D) → positive signal.

If it’s just for repaying old debt → mixed signal.

If it’s only an exit for existing investors → caution.

👉 Always read the “Objects of the Issue” section in the DRHP. It tells you exactly where your money is going.

3. Can We Trust GMP and Subscription?

Grey Market Premium (GMP): A useful but imperfect signal. GMP often tracks sentiment, but it is not always reliable. (Studies show GMP has a ~60–70% correlation with actual listing price, not 100%.)

Subscription Data: More telling. Look at how institutional and HNI categories are bidding.

Fun fact: In India, almost 80% of retail bids come on the last day to avoid locking up capital early.

If QIBs (Qualified Institutional Buyers) show strong demand → good sign.

4. Should You Exit on Listing Day?

This depends on the offer composition:

If it’s largely a Fresh Issue, existing shareholders are still invested in the company. Better chance of holding for long-term value creation.

If it’s mostly OFS, insiders are leaving. Taking listing gains might be safer.

5. Case Studies: Hype vs. Reality

Zomato IPO (2021):

Mix of fresh issue + OFS.

Fresh funds were earmarked for growth and expansion.

Strong demand from institutions.

Result: Successful listing and continued relevance as a listed company. But later, the stock corrected sharply before recovering as the business matured.

Lesson: A good listing doesn’t guarantee long-term returns.

Paytm IPO (2021):

Heavy OFS component.

Valuation concerns + insiders exiting.

Retail investors got caught in the hype.

Result: One of the worst listings in India’s IPO history, with shares crashing ~40% soon after listing.

Lesson: When an IPO is dominated by OFS and valuations look stretched, insiders may be exiting at your expense. Don’t get swayed by hype — if institutions aren’t backing it strongly and fundamentals don’t justify the price, retail investors are left holding the bag.

6. The IPO Investor’s Checklist

Before applying, ask yourself these 4 questions:

✅ Is it an OFS or a Fresh Issue?

✅ Where will the raised money be used?

✅ What do GMP and subscription data say?

✅ Are valuations reasonable compared to peers?

Final Thought

An IPO isn’t just about short-term gains. It’s about understanding who’s selling, why they’re selling, and how the company plans to use your money.

So the next time you see IPO hype, don’t just check GMP, check the story behind it.

💬 Your turn → Which IPO did you apply for and regret (or celebrate)? Reply and I’ll feature the most interesting stories in the next issue.

PS - Thanks to my brother for collaborating on this article. Always love such discussions.

Thanks for this information sister ❤️👍🏻

i hope that the information is useful and encourage my curiosity for my profession CA ☺️

Your fundamentals and presentation style is exceptionally good. Firstly the case then the real life examples. Always wished to learn from you and here it starts!